Introduction

As we step into 2023, the financial world continues to be plagued with uncertainties. In such times, investing in gold coins has emerged as a reliable way to secure and preserve your wealth.

This comprehensive guide delves deep into the top 10 best gold coins for investment in 2023, essential factors to consider before investing, and tips on how to buy these precious treasures.

Key Takeaways

- Investing in gold coins in 2023 can help hedge against inflation and economic uncertainty, diversify your investment portfolio, and potentially appreciate in value.

- Factors to consider before investing in gold coins include the purity and weight of gold, rarity and collectibility, country of origin, condition and packaging, as well as historical significance.

- The top 10 best gold coins for investment in 2023 are American Gold Eagle, Canadian Gold Maple Leaf, South African Krugerrand, Australian Gold Kangaroo, British Gold Britannia, Chinese Gold Panda,Austrian Gold Philharmonic,Mexican Gold Libertad ,SwissGold Franc,and IndianGold Sovereign. These coins offer a variety of options based on purity level,historical significance,country of origin,Rarity,and liquidity.

- When investing in gold coins it’s crucial to purchase from authorized dealers or online stores that provide security and peace of mind during the purchasing process.

Why Invest In Gold Coins In 2023?

Investing in gold coins in 2023 can help hedge against inflation and economic uncertainty, diversify your investment portfolio, and potentially appreciate in value.

Hedge Against Inflation And Economic Uncertainty

In 2023, investing in gold coins can serve as a practical hedge against inflation and economic uncertainty. This is particularly important for individuals interested in off-grid living, who often seek financial stability amidst volatile market conditions.

With central banks continuing to implement aggressive monetary policies such as quantitative easing and low (or even negative) interest rates, fiat currencies may experience devaluation over time.

For example, during the financial crisis in 2008, many traditional investments plummeted while gold prices soared due to increased demand for this safe-haven asset. By allocating a portion of your investment portfolio into gold coins like American Gold Eagles or Canadian Maple Leafs, you can effectively shield yourself from macroeconomic risks that could diminish your purchasing power and pose challenges to self-sufficient living.

Portfolio Diversification

Investing in gold coins can provide an excellent opportunity for portfolio diversification. Adding gold bullion or numismatic coins to a portfolio that already includes stocks, bonds, and real estate can help reduce overall risk.

As a safe haven asset, gold often performs well during times of economic instability making it an important part of any investor’s financial security plan.

Furthermore, investing in different types of gold coins can also offer diversification within a precious metals investment strategy. Some investors prefer government minted bullion coins like American Gold Eagles or Canadian Gold Maple Leafs while others may choose to invest in rare collector grade pieces such as Indian Gold Sovereigns or Swiss Gold Francs.

Potential Appreciation

Investing in gold coins can potentially lead to appreciation in value over time. As the demand for gold increases, so does its price, making it a valuable asset for investment.

Some rare and collectible gold coins may appreciate even further due to their historical significance or limited supply. For example, the South African Krugerrand was first minted in 1967 and became popular as a way for individuals to invest in physical gold during times of economic uncertainty.

Today, this coin is highly sought after by collectors and investors alike, making it a great option for potential appreciation in years to come. Other options like the American Gold Eagle and Canadian Gold Maple Leaf are also worth considering as they are recognized globally and have consistently increased in value over time.

Factors To Consider Before Investing In Gold Coins

Before investing in gold coins, it is crucial to consider factors such as the purity and weight of gold, rarity and collectibility, country of origin, condition and packaging, as well as historical significance.

Purity And Weight Of Gold

When investing in gold coins, it’s important to consider the purity and weight of the gold content. The purity of gold is measured using a unit called “karats,” with 24 karat being pure gold.

The higher the number of karats, the higher the purity level of the gold coin.

The weight of a gold coin also plays an important role in its value. Gold coins are typically weighed in troy ounces, with one troy ounce being equal to about 31 grams. Heavier coins tend to be more valuable due to their larger amount of actual gold content.

Rarity And Collectibility

When it comes to investing in gold coins, rarity and collectibility are important factors to consider. Some gold coins are more limited in availability and therefore have a higher premium over their gold content.

For example, the British Gold Britannia has some years where its mintage is limited to only a few thousand coins, making them highly sought after by collectors. The Royal Tudor Beasts – Lion of England is another coin with limited mintage that can increase its value due to collectibility.

However, it’s essential to note that while rare or collector’s items may appreciate over time, they may not necessarily hold their value as well as more widely recognized bullion coins such as American Gold Eagles or Canadian Gold Maple Leafs.

Country Of Origin

Another important factor to consider before investing in gold coins is the country of origin. This can affect not only the coin’s value but also its liquidity. Some countries, such as the United States and Canada, have a long history of producing high-quality gold coins that are widely recognized and traded globally.

These coins may be more liquid than those from newer or less established mints.

For instance, American Gold Eagles and Canadian Gold Maple Leafs are highly sought-after due to their quality, purity, and reliable government backing. On the other hand, collectors may seek out rarer coins from smaller countries for their historical significance or limited mintage numbers.

Condition And Packaging

When it comes to investing in gold coins, the condition and packaging of the coins are crucial factors to consider. A coin’s condition refers to its physical appearance, including any scratches, dents, or other imperfections.

The better a coin’s condition is, the more valuable it will be.

For example, if you’re looking for a popular gold bullion coin like American Gold Eagles or Canadian Maple Leafs as part of your off-grid living plan’s investment strategy in 2023, make sure you look out for reputable dealers who have certified these coins’ quality and offer them in their original sealed packaging.

Historical Significance

Gold coins have a rich and fascinating history, making them more than just an investment but also a collector’s item. Many of the gold coins on our list have significant historical value, such as the South African Krugerrand which was first minted in 1967 to help market South African gold.

On the other hand, American Gold Eagles are highly sought after for their design that features Lady Liberty holding an olive branch and torch, originally created by Augustus Saint-Gaudens in 1907.

Additionally, Chinese Gold Pandas depict various designs each year depicting China’s cultural heritage or landmarks with intricate details that make them very collectible.

Collectors interested in owning a piece of history can focus on acquiring numismatic coins or older versions of popular bullion coins which tend to appreciate over time due to their rarity and high demand among collectors.

Overall, understanding the historical significance of gold coins can impact investment decisions while allowing investors to connect with these timeless pieces for generations to come.

Top 10 Best Gold Coins For Investment In 2023

The top 10 best gold coins for investment in 2023 include the American Gold Eagle, Canadian Gold Maple Leaf, South African Krugerrand, Australian Gold Kangaroo, British Gold Britannia, Chinese Gold Panda, Austrian Gold Philharmonic, Mexican Gold Libertad, Swiss Gold Franc and Indian Gold Sovereign.

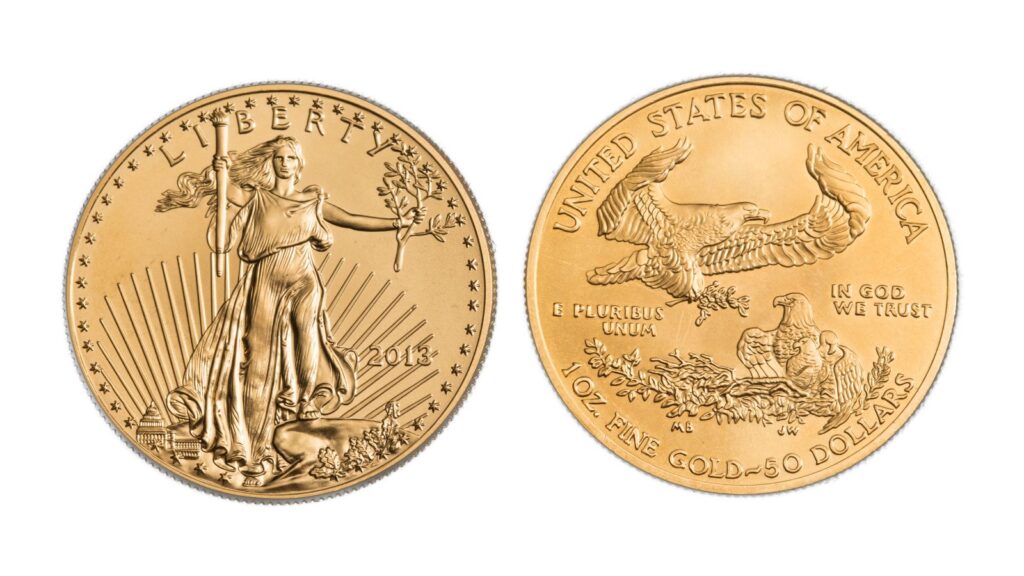

1. American Gold Eagle

The American Gold Eagle is a popular gold coin among investors due to its high-quality standards, government guarantee, and liquidity. It contains one troy ounce of 22-karat gold with trace amounts of silver and copper, making it more durable than other pure gold coins.

The design features Lady Liberty on the obverse and an eagle family on the reverse, symbolizing patriotism and national pride. American Gold Eagles are recognized worldwide as legal tender with a face value of $50 but are typically bought at market value or higher.

2. Canadian Gold Maple Leaf

The Canadian Gold Maple Leaf is a popular choice for investors looking to buy gold coins in 2023. Standing as one of the purest gold coins on the market, it has a purity level of .9999 fine gold, making it highly valuable and easily tradable.

The coin was first introduced by the Royal Canadian Mint in 1979 and features an iconic design with a portrait of Queen Elizabeth II on one side and a maple leaf on the other.

Aside from its beauty, investing in this coin also provides peace of mind knowing that purchases are tax-free within Canada under certain conditions.

3. South African Krugerrand

The South African Krugerrand is one of the most popular gold coins for investment in 2023. It was first minted by the South African Mint in 1967 and quickly became a global favorite due to its high gold content and low premium.

The Krugerrand contains 22 karat gold, and its design features the iconic Springbok antelope on one side, with Paul Kruger, a former president of South Africa, on the other.

Its widespread recognition makes it an easily tradable asset throughout the world.

4. Australian Gold Kangaroo

One of the best gold coins for investment in 2023 is the Australian Gold Kangaroo. This coin has a purity of 99.99% and comes in various sizes, making it ideal for investors with different budgets.

The design of the coin features the iconic kangaroo, which changes every year, adding to its collectibility value. In addition, buying this gold coin provides an opportunity for portfolio diversification and wealth preservation as it is recognized globally and holds value even during times of economic instability.

5. British Gold Britannia

The British Gold Britannia is a popular gold coin that has been minted by the Royal Mint since 1987. This beautiful coin features the iconic image of Britannia, the female personification of Great Britain, on its reverse side.

It is made from 22-carat gold and contains one troy ounce of pure gold.

Investing in British Gold Britannias can also offer great tax benefits for UK investors as they are exempt from capital gains tax when sold at a profit. Moreover, their value tends to appreciate over time due to rising demand and scarcity factors.

6. Chinese Gold Panda

The Chinese Gold Panda is a highly sought-after gold coin for investment in 2023. Over the years, it has become one of the most popular bullion coins due to its unique design and high purity levels of 99.9%.

With its annual design change featuring the iconic panda, this gold coin appeals to collectors as well as investors. The Chinese Gold Panda ranges from 1/20 oz up to 1 kg and is recognized globally as legal tender by the government of China.

Note:

– The Chinese Gold Panda is a highly sought-after gold coin for investment in 2023.

– It has become one of the most popular bullion coins due to its unique design and high purity levels of 99.9%.

– The Chinese Gold Panda ranges from 1/20 oz up to 1 kg and is recognized globally as legal tender by the government of China.]

7. Austrian Gold Philharmonic

The Austrian Gold Philharmonic is one of the most popular gold bullion coins for investment in 2023. This coin was first introduced in 1989 and features a design that celebrates Austria’s rich cultural heritage.

The obverse side of the coin depicts the great organ found within Vienna’s Golden Hall, home to the Vienna Philharmonic Orchestra.

Investors are drawn to this gold coin due to its high purity (99.99% pure), as well as its impressive liquidity and low premiums. Additionally, it provides a unique opportunity for investors focused on portfolio diversification.

8. Mexican Gold Libertad

Mexican Gold Libertad is one of the most sought-after gold coins among investors due to its historical significance and rarity. The coin was first minted in 1981 by Mexico’s National Mint and quickly became a popular choice for collectors worldwide.

It features the iconic Angel of Independence on the obverse side, symbolizing Mexico’s freedom from Spanish colonial rule. Mexican Gold Libertads come in a variety of sizes, ranging from 1/20 ounce to 1 kilogram, providing investors with flexibility and liquidity options when buying gold coins.

9. Swiss Gold Franc

The Swiss Gold Franc is another popular gold coin for investment in 2023. It was first introduced in 1897 and since then it has been considered one of the most stable currencies worldwide due to Switzerland’s political neutrality and economic stability.

The Swiss Gold Franc has a purity level of .900, with a weight of 5.8 grams, which makes it a great option for fractional gold investments. Moreover, this coin is recognized globally, making it easier for investors to sell or trade if they need quick cash.

10. Indian Gold Sovereign

The Indian Gold Sovereign is a rare and highly collectible gold coin that is ideal for long-term investment. This 22-carat gold coin was first issued in 1835 by the British East India Company and continued to be minted until 1918.

The obverse features an effigy of Queen Victoria while the reverse depicts an image of Saint George slaying a dragon. With only a limited number of coins available on the market, collectors can expect significant appreciation in value over time.

Investing in Indian Gold Sovereigns also provides investors with a piece of history as these coins played an important role during India’s colonial era.

How To Buy Gold Coins

You can purchase gold coins from authorized dealers, online stores or auction houses, but understanding the different options and pricing is key.

Authorized Dealers

Investing in gold coins requires a certain level of expertise to ensure that you get the best value for your money. One way to do this is by purchasing from authorized dealers who can provide you with insights into the current market trends and help verify the authenticity of your gold coins.

Popular authorized dealers include online stores such as APMEX, JM Bullion, and Provident Metals, as well as traditional brick-and-mortar stores like Goldline and Kitco. It’s important to research these dealers thoroughly before making a purchase to ensure their reputation for quality service and customer satisfaction.

Online Stores

One of the most convenient ways to buy gold coins is through online stores. These stores offer a wide range of options and make it easy for potential investors to compare prices, check reviews, and find reputable sellers.

It’s important to note that when buying from an online store, investors should do their due diligence and ensure that the seller is trustworthy. Additionally, they should consider shipping costs and delivery timeframes before making a purchase.

Auction Houses

Auction houses can be a great place to buy gold coins for investment. They offer unique and rare coins that are not commonly found in other markets, making them an excellent option for collectors.

Additionally, the competition among bidders at auctions often drives up prices, which means that investors could potentially make significant profits if they hold onto their purchases long enough.

Some notable auction houses include Christie’s, Sotheby’s, and Heritage Auctions.

Finally, it is crucial for potential coin investors to consult with professionals who have extensive knowledge of the market concerning all types of precious metals investments.

Benefits Of Investing In Gold Coins In 2023

Investing in gold coins is a secure way to diversify your portfolio and protect against inflation, economic instability, and global market changes.

Security And Stability

Investing in gold coins can provide a sense of security and stability for individuals interested in off grid living. With uncertain economic climates and volatile stock markets, owning physical gold bullion coins can be a reliable store of wealth.

Gold is considered a safe haven asset that tends to hold value during times of economic turmoil or uncertainty. In fact, throughout history, gold has maintained its purchasing power even during times when paper currencies have lost theirs.

Diversify Investment Portfolio

Diversifying one’s investment portfolio is crucial for people interested in off-grid living who are looking to mitigate risks and maximize returns. Holding gold bullion coins can provide an excellent way to diversify a portfolio, as they are considered safe havens in times of economic uncertainty.

Owning different types of gold coins from various countries with varying weights and purities can also add further diversity to the portfolio. For instance, buying American Gold Eagles alongside Canadian Gold Maple Leafs or South African Krugerrands can ensure exposure to different markets and currencies, which helps balance risk and reward.

Preservation Of Wealth

Investing in gold coins is a great way to preserve wealth, especially for those interested in off-grid living. With the global economy constantly fluctuating, gold can serve as a hedge against inflation and other uncertainties.

Unlike paper currency or digital assets, physical gold has inherent value that is not dependent on government policies or market trends. Additionally, holding gold coins allows investors to diversify their portfolio beyond traditional stocks and bonds.

In times of economic turmoil and financial instability, owning tangible assets like gold coins can provide peace of mind and security for individuals looking to secure their long-term wealth.

Potential As A Family Heirloom

Investing in gold coins not only provides a secure financial future but can also serve as a family heirloom. Passing down gold coins from generation to generation is a way of preserving wealth and sharing an important part of one’s history.

An example of this is the British Gold Sovereign, which features a design that has remained virtually unchanged for over 200 years. It represents a tangible piece of history and has become synonymous with the British Empire itself.

Conclusion

In conclusion, investing in gold coins can be a smart choice for those looking to diversify their portfolio and protect against economic uncertainty. The top 10 gold coins outlined in this guide offer a variety of options based on purity, rarity, country of origin, and historical significance.

It’s important to consider these factors before making an investment decision. Remember that buying from authorized dealers or online stores provides security and peace of mind during the purchasing process.

FAQs:

1. What are the benefits of investing in gold coins?

Investing in gold coins offers a number of benefits, including a hedge against inflation and economic uncertainty, as well as the potential to earn significant gains over time. Gold is considered a safe haven asset that tends to retain its value even during periods of market volatility.

2. Are certain types of gold coins better investments than others?

Yes, some types of gold coins tend to be better investments than others due to factors such as rarity, historical significance, and condition. This guide provides information on the top 10 best gold coins for investment in 2023 based on these criteria.

3. Should I buy new or vintage gold coins for investment purposes?

Both new and vintage gold coins can be good options for investment purposes depending on your goals and preferences. Newer Gold Eagles or Gold Buffalos may offer more liquidity while historic rare finds have potential gains that exceed their metal content; however it is important consult with an accredited dealer first before purchasing any valuable currency.

4. How much should I expect to pay for one of the top 10 best gold coins featured in this guide?

The prices for each individual coin will vary depending upon market conditions at time point-of-purchase so it’s difficult highlight specific costs – but generally speaking you want spend wisely by researching trends & seeking out reputable dealers who have strong track records verified through online reviews or word-of-mouth testimonials from other satisfied customers .